Should I Form a Family Office?

When to Start a Family Office

Your family business has grown and prospered beyond your dreams, your wealth is growing, and friends are telling you it is time to start a family office. You are confused, recognizing that you aren’t the Rockefeller or Gates family, and wonder if a family office is really right for your needs.

How do you know whether you should start such an office?

Let’s detour briefly to define what a family office is. In simple terms, a family office is a private organization created to oversee and manage the financial needs of a specific family. They may be as small as one or two staff, supported by a network of outsourced advisors, or they may include 20 or more employees. The ideal family office is a mix of insourced and outsourced services, leveraging a network of expert advisors.

There are a series of factors that weigh into the decision. We constantly meet families who are wrestling with this question, and there rarely are easy or clear-cut answers. However, if factors suggesting a family office outweigh the ones suggesting not, then the family may decide to move forward.

Let’s discuss seven key factors to consider when making this decision:

- High wealth complexity. Is the burden of administering your wealth and holdings outweighing the benefits of that wealth? Families with multiple houses with maintenance, staffing, and potential renovations often find they want additional support. Other families have assets spread across various trusts and entities, with a long list of asset managers and custodians. Often, such families struggle with knowing their total worth, identifying all of their holdings, and tracking their spending.

- Multi-generations. There certainly are first generation wealth-owners without children who can justify a family office, but most often, family offices benefit families who are planning across three or more generations.

- Privacy. A family office can be a tool for protecting the family’s privacy about its wealth and activities.

- Legacy. What is the family’s desired legacy across the next 50 to 100 years? Is there a desire to build and maintain family unity across generations, held together by common values, history and perhaps a business or other holdings? Other families want to split the wealth at each generation, giving each person freedom and flexibility to go their own way.

- Control. Families often form a family office to give themselves greater control over investments, holdings and staff compared to using outsourced investment firms.

- Cost. Hiring staff, with facilities and equipment, can be expensive. Frequently, one can outsource services or use a multi-family office for a lower cost. When the importance of the other factors listed here out-weigh concerns about cost, then a family office is feasible.

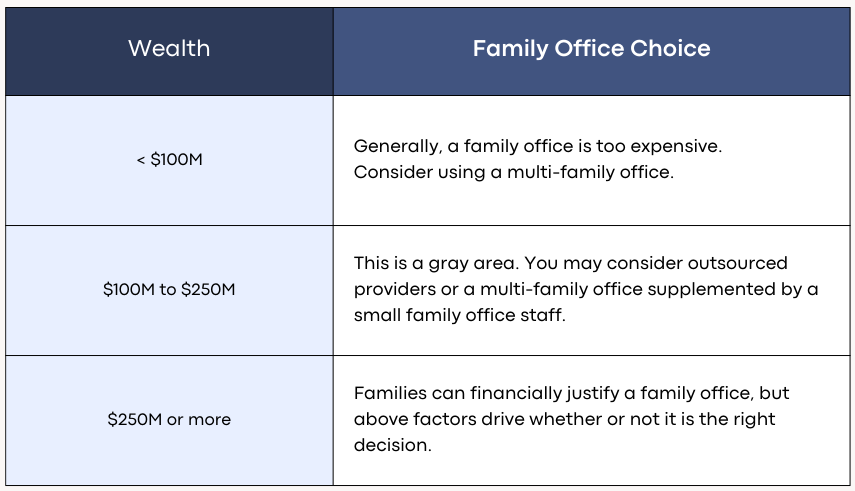

- Wealth level. The typical question is, “at what level of wealth should I start a family office?” Are we discussing overall wealth, including the business, or just marketable wealth? The right answer, of starting a family office or not, depends on the above factors just as much as wealth. However, since we are pressed for an answer, here is a rough guideline:

Advice and assistance from external parties can be beneficial for families who are unsure of whether to establish a family office. Such observers may be able to pinpoint the family’s challenges, guiding them to the best decision for their family.